Analysis of Trades and Trading Tips for the Euro

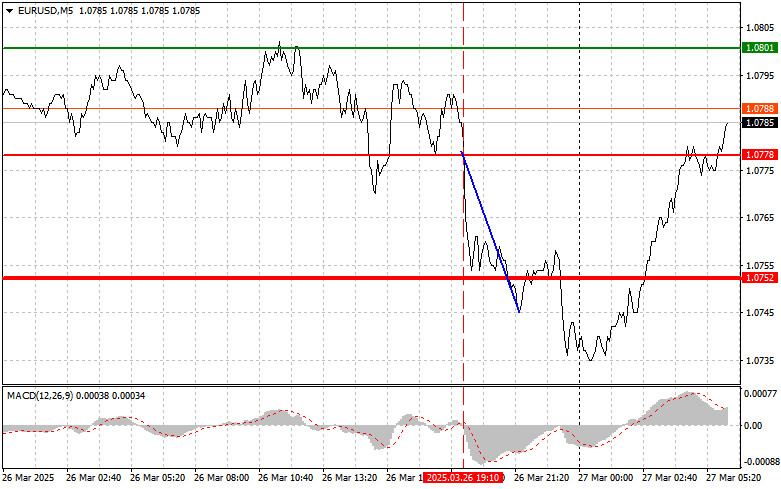

The price test at 1.0778 occurred just as the MACD indicator began to move down from the zero line, confirming a valid entry point for selling the euro. As a result, the pair dropped by 30 pips.

Strong U.S. data and fresh headlines about American trade tariffs boosted the U.S. dollar. Yesterday, Donald Trump signed an executive order imposing a 25% tariff on car imports, further escalating the trade war. While this decision didn't surprise markets, it intensified fears of a global recession. Against this backdrop, traders preferred to move into the dollar, which is considered a safer asset during times of uncertainty. The euro, by contrast, came under pressure due to concerns that the European economy—particularly its auto industry—would suffer more from the trade restrictions.

Today, attention will shift to fresh data on the eurozone's M3 money supply and private sector lending volumes. Economists and investors closely monitor these indicators, serving as barometers of the region's economic health. Of particular importance is the trend in private-sector lending. A decline in lending usually signals reduced business activity and consumer demand. As businesses and households grow more cautious about borrowing, economic growth may slow, weakening the euro in the short term.

Traders will also be closely watching European Central Bank President Christine Lagarde's speech. Her comments on the inflation outlook and future monetary policy steps could significantly impact the euro and overall market sentiment. Any hints at further monetary easing—especially after the recent signs of slowing price pressures in the eurozone—could trigger additional selling pressure on the euro against the dollar.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

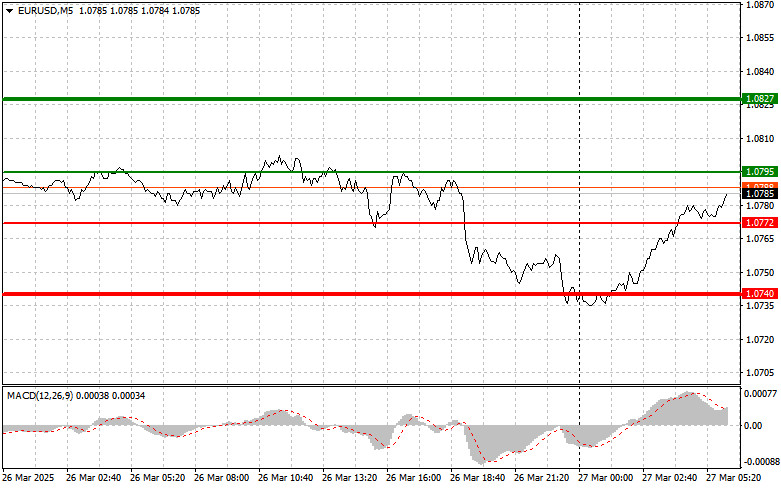

Scenario #1: Buy the euro today at the 1.0795 level (green line on the chart) with a target of 1.0827. At 1.0827, I plan to exit long positions and open short positions for a pullback of about 30–35 pips. Important: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: Buy the euro if the price tests the 1.0772 level twice consecutively while the MACD is in oversold territory. This would limit the pair's downside potential and suggest a market reversal to the upside. Expect a rise toward 1.0795 and 1.0827.

Sell Signal

Scenario #1: Sell the euro after the price hits 1.0772 (red line on the chart), targeting 1.0740. I plan to exit short positions at 1.0740 and enter long positions for a 20–25 pip rebound. Important: Before selling, ensure that the MACD indicator is below the zero line and beginning to decline.

Scenario #2: Sell the euro if the price tests 1.0795 twice in a row while the MACD is in overbought territory. This will cap the upside potential and may trigger a market reversal to the downside. Expect a decline toward 1.0772 and 1.0740.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.