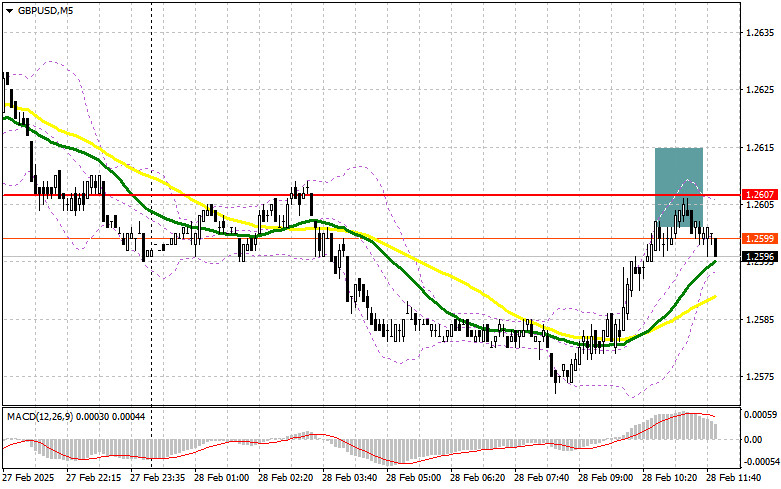

In my morning forecast, I focused on the 1.2607 level as a key decision point for entering the market. Looking at the 5-minute chart, the price moved higher but fell just short of testing and forming a false breakout around 1.2607, so I ended up without any trades. The technical picture has been revised for the second half of the day.

To Open Long Positions on GBP/USD:

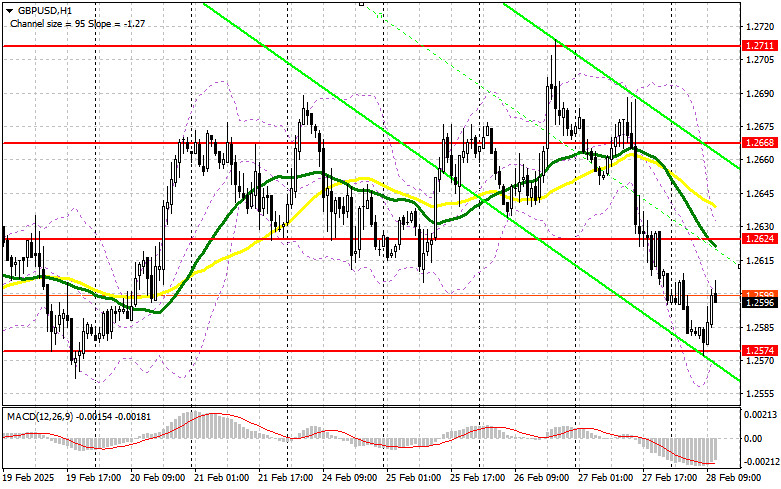

The absence of economic data from the UK has not helped the pound recover, so the focus now shifts to U.S. data releases. Key figures such as the Core Personal Consumption Expenditures (PCE) Index, changes in household spending and income, and the goods trade balance will dictate the dollar's direction. If the U.S. reports are strong, another decline in GBP/USD could occur by the end of the week. If sellers attempt to push the pair to new weekly lows, I plan to enter long positions only after a false breakout at 1.2574. The immediate target for buyers will be 1.2624, which the pair failed to reach in the first half of the day. A breakout and retest from above will confirm a new buying opportunity, aiming for 1.2668, which would halt the bearish correction. The farthest target will be 1.2711, where I plan to take profit.

If GBP/USD declines and bulls fail to defend 1.2574 in the second half of the day, selling pressure on the pound will increase significantly. In this scenario, I will only consider buying after a false breakout at 1.2528. I plan to open long positions on an immediate rebound from 1.2480, aiming for an intraday correction of 30-35 points.

To Open Short Positions on GBP/USD:

Sellers missed an opportunity earlier, and now everything depends on U.S. economic data. The primary task for bears is to defend the 1.2624 resistance, where the moving averages also favor sellers. A false breakout at this level will provide an entry point for short positions, aiming for 1.2574. A break and retest from below will trigger stop-loss orders, opening the path toward 1.2528. The farthest target is 1.2480, where I plan to take profit. Testing this level could reinforce the downtrend.

If demand for the pound returns in the second half of the day and sellers fail to defend 1.2624, the pair could continue its bullish trend. In this case, I will delay short positions until a test of 1.2668. I will enter shorts only after a failed breakout at that level. If there is no downward movement even at 1.2668, I will look for short positions on an immediate rebound from 1.2711, aiming for a 30-35 point correction.

COT Report Analysis:

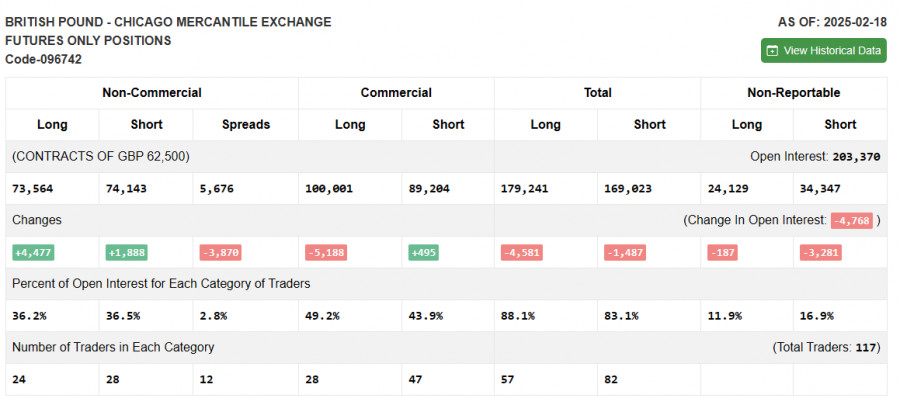

The Commitment of Traders (COT) report from February 18 showed an increase in both long and short positions, with long positions rising at a higher pace. This indicates renewed interest in buying the pound, but the market remains in relative balance between bulls and bears.

Data on UK inflation growth and retail sales, which continue pushing the Consumer Price Index (CPI) higher, are likely to force the Bank of England to adopt a more cautious approach to interest rate cuts. This could support the pound in the long run.

According to the COT report, long non-commercial positions increased by 4,477 to 73,477, while short non-commercial positions rose by 1,888 to 74,143. As a result, the gap between long and short positions decreased by 3,870.

Indicator Signals:

Moving Averages:

Trading is occurring below the 30- and 50-day moving averages, indicating a continuation of the downtrend.

Bollinger Bands:

If the pair declines, the lower boundary of the Bollinger Bands at 1.2574 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing out volatility and market noise.

- MACD Indicator (Moving Average Convergence/Divergence): Measures the relationship between 12-period EMA, 26-period EMA, and a 9-period SMA.

- Bollinger Bands: Measures market volatility using a 20-period moving average with upper and lower bands.

- Non-Commercial Traders: Include speculators, hedge funds, and large institutions that use the futures market for speculative purposes.

- Long Non-Commercial Positions: The total long exposure held by non-commercial traders.

- Short Non-Commercial Positions: The total short exposure held by non-commercial traders.

- Net Non-Commercial Position: The difference between short and long positions among non-commercial traders.