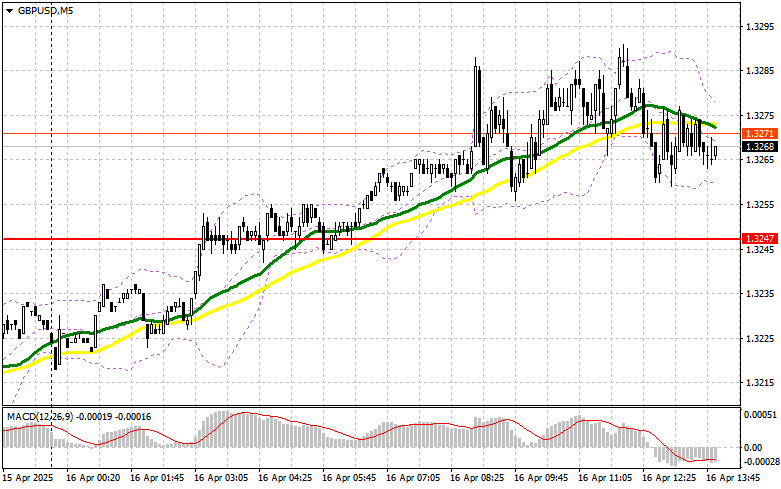

In my morning forecast, I highlighted the 1.3247 level as a reference point for market entry decisions. Let's take a look at the 5-minute chart and analyze what happened. The pair did decline, but it never reached a test of 1.3247, so I remained out of the market. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD:

This morning's news of slowing inflation in the UK during March limited the pound's upward potential against the dollar. Clearly, such data gives the Bank of England more flexibility to cut interest rates, which in the short term is negative for the British currency.

In the second half of the day, only weak U.S. retail sales data for March could trigger a new bullish wave in GBP/USD, as relying on a dovish speech from Fed Chair Jerome Powell seems unrealistic. If the U.S. data is strong, pressure on the pair will return.

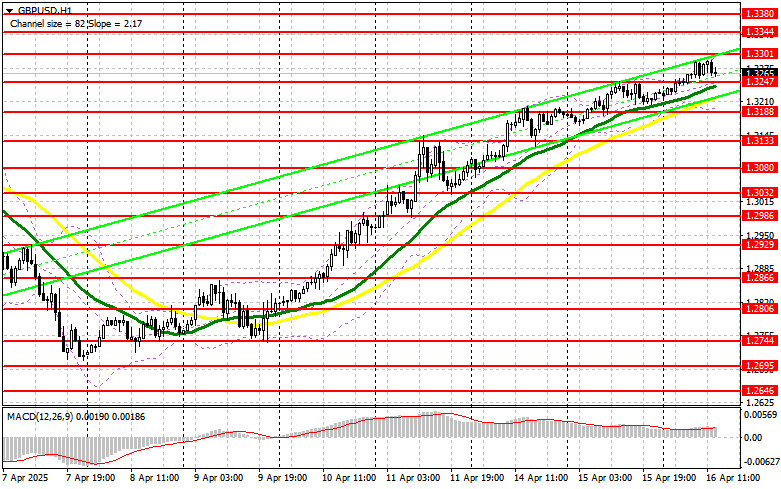

In that case, I will act on a correction after a false breakout around the 1.3247 support level formed in the first half of the day. This would offer a good entry point for long positions, targeting a recovery to resistance at 1.3301. A breakout and retest of this area from above will provide a new buy signal with potential for a move toward 1.3344, strengthening the bullish trend. The most distant target will be the 1.3380 area, where I plan to take profit.

If GBP/USD declines and there is no buyer activity near 1.3247 in the second half of the day, pressure on the pair will intensify. In that case, only a false breakout around 1.3188 would justify opening long positions. I also plan to buy GBP/USD directly on a rebound from 1.3133, targeting an intraday correction of 30–35 points.

To open short positions on GBP/USD:

Sellers have shown little activity so far—there hasn't been a strong reason to act. If GBP/USD rises again during the U.S. session after the data releases, only a false breakout at 1.3301 will provide an entry point for short positions, aiming for a decline toward the new support at 1.3247. Slightly below that level are the moving averages, currently favoring the bulls.

A breakout and retest of this range from below will trigger stop-loss orders and open the way to 1.3188. The final target will be the 1.3133 area, where I plan to take profit.

If demand for the pound remains strong in the second half of the day (which is more likely) and bears fail to act around 1.3301, I'll postpone short positions until a test of resistance at 1.3344. I will sell there only after a failed breakout. If there's no downward movement from that point either, I'll look for short entries at 1.3380—but only for a 30–35 point downward correction.

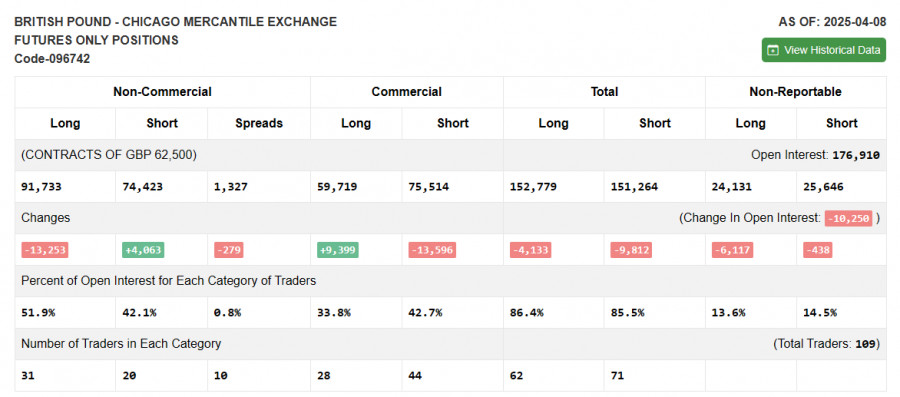

COT Report (Commitments of Traders) – April 8:

The report showed a slight increase in short positions and a decrease in longs. It's worth noting that this report reflects Trump's decision to freeze tariffs for 90 days but does not account for the recent positive UK GDP data. Despite this, demand for the pound remains strong, as indicated by the advantage of buyers over sellers in the report.

According to the latest COT report, long non-commercial positions fell by 13,253 to 91,733 and short non-commercial positions rose by 4,063 to 74,423. As a result, the gap between long and short positions decreased by 279.

Indicator Signals:

Moving Averages: Trading is above the 30- and 50-period moving averages, indicating continued bullish momentum.

Note: The author uses the H1 chart, which may differ from the standard daily moving average interpretation on the D1 timeframe.

Bollinger Bands: In case of a decline, the lower band around 1.3190 will serve as support.

Indicator Descriptions:

- Moving Average (smooths volatility and noise to identify the current trend), Period: 50, marked in yellow on the chart;

- Moving Average, Period: 30, marked in green on the chart;

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12; Slow EMA – period 26; SMA – period 9;

- Bollinger Bands, Period: 20;

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes;

- Long non-commercial positions represent the total long open interest from non-commercial traders;

- Short non-commercial positions represent the total short open interest from non-commercial traders;

- Net non-commercial position is the difference between long and short non-commercial positions.