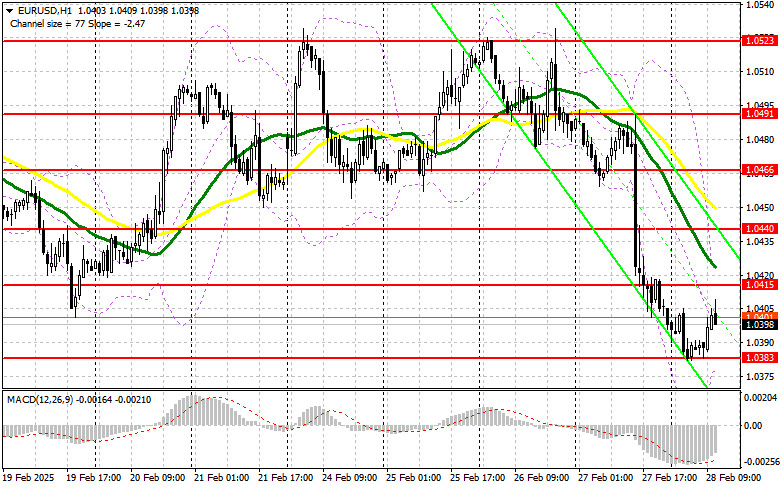

In my morning forecast, I focused on the 1.0404 level as a key decision point for entering the market. Looking at the 5-minute chart, we see that the price rise and a false breakout at this level provided a short position entry. However, at the time of writing this new analysis, the pair had not yet shown a strong downward movement. The technical outlook has been adjusted for the second half of the day.

To Open Long Positions on EUR/USD:

Disappointing retail sales data from several Eurozone countries has limited the euro's upward correction against the U.S. dollar. However, more significant U.S. economic reports are still ahead, which means that market movement is inevitable. The Core Personal Consumption Expenditures (PCE) Index and changes in U.S. consumer spending will be key factors in determining the dollar's direction. If these indicators rise, the U.S. dollar will strengthen, leading to further EUR/USD declines, which I plan to take advantage of. A false breakout at the new support level of 1.0383 will provide a good buying opportunity, targeting the 1.0415 resistance, formed at the end of yesterday's session. A breakout and retest of this range from above will confirm the correct long entry, aiming for 1.0440. The farthest target is 1.0466, where I plan to take profit.

If EUR/USD declines and there is no buying activity around 1.0383 by the end of the week, which is unlikely, euro bulls will lose control, and sellers could push the pair down to 1.0354, marking a new weekly low. Only after a false breakout at this level will I consider buying the euro. I plan to open long positions on an immediate rebound from 1.0321, aiming for a 30-35 point intraday correction.

To Open Short Positions on EUR/USD:

Sellers are acting cautiously, relying on fundamental factors. If EUR/USD rises in the second half of the day following weak U.S. data and signs of easing inflationary pressure, the 1.0415 resistance will be a key area to defend. A false breakout at this level will confirm a short position entry, targeting 1.0383 support. A break and consolidation below this range, followed by a retest from below, will offer another opportunity to sell, pushing the pair toward 1.0354, reinforcing the bearish sentiment in the market. The farthest target for shorts is 1.0321, where I plan to take profit.

If EUR/USD rises in the second half of the day and sellers fail to show activity at 1.0415, which is unlikely, buyers could regain control and push the pair higher. In this case, I will delay short positions until a test of the next resistance at 1.0440, where the moving averages favor sellers. I will sell only after an unsuccessful breakout. I also plan to sell on an immediate rebound from 1.0466, aiming for a 30-35 point downward correction.

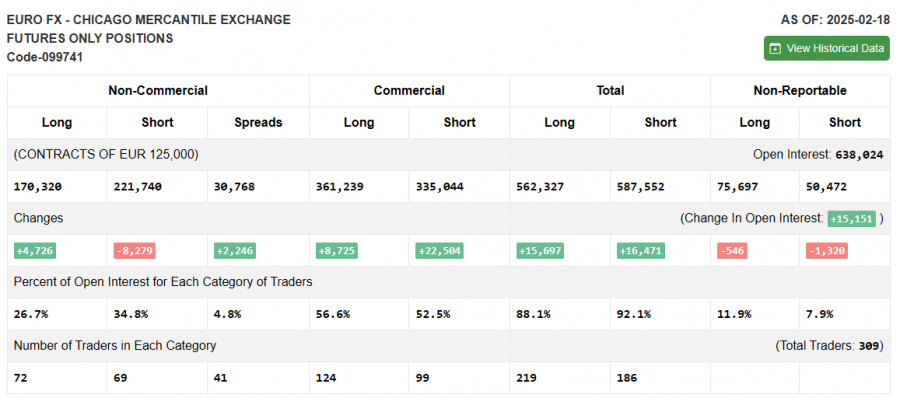

COT Report Analysis:

The Commitment of Traders (COT) report from February 18 showed an increase in long positions and a significant reduction in short positions. The number of buyers of the euro has risen again, largely due to ongoing negotiations between Russia and the U.S. regarding the Ukraine conflict resolution. The potential end of military actions in the coming months boosts demand for risk assets, supporting the troubled euro. However, sellers still dominate the market, meaning that buying at highs should be approached with caution.

According to the COT report, long non-commercial positions increased by 4,726 to 170,320, while short non-commercial positions decreased by 8,279 to 221,740. As a result, the gap between long and short positions widened by 2,246.

Indicator Signals:

Moving Averages:

Trading is occurring below the 30- and 50-day moving averages, signaling a continuation of the pair's downtrend.

Bollinger Bands:

If the pair declines, the lower boundary of the Bollinger Bands at 1.0380 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing out volatility and market noise.

- MACD Indicator (Moving Average Convergence/Divergence): Measures the relationship between 12-period EMA, 26-period EMA, and a 9-period SMA.

- Bollinger Bands: Measures market volatility using a 20-period moving average with upper and lower bands.

- Non-Commercial Traders: Include speculators, hedge funds, and large institutions that use the futures market for speculative purposes.

- Long Non-Commercial Positions: The total long exposure held by non-commercial traders.

- Short Non-Commercial Positions: The total short exposure held by non-commercial traders.

- Net Non-Commercial Position: The difference between short and long positions among non-commercial traders.