Today, the dollar index is trying to limit the falls of the last few days and is above 104.2. The EUR/USD exchange rate approached the 1.0900 mark.

This is more of an emotional outburst. The markets are evaluating the new inflation figures in the US. Already today, emotions should subside, as traders will start analyzing the situation with a cool head.

After the inflation publication, the head of the Federal Reserve Bank of Minneapolis confirmed that it will probably be necessary to keep the rate at the current level for some more time and expressed doubts about how much it is holding the US economy back.

Experts at the Bank of America remain in the same position, believing that the first rate cut will not occur until December. To cut the rate in September, it is necessary that inflation slows further or labor market data weaken even more.

Still, the yield on 10-year US Treasury bonds fell to 4.32% on Wednesday, the lowest level since early April, as softer inflation data gives the Fed more flexibility to cut rates this year.

The dollar index has weakened over the past few days. The DXY is now near the price lows of April (103.95), which is the nearest support level. Perhaps within this range, the dollar's weakening will temporarily slow down. At least that is the picture we see now.

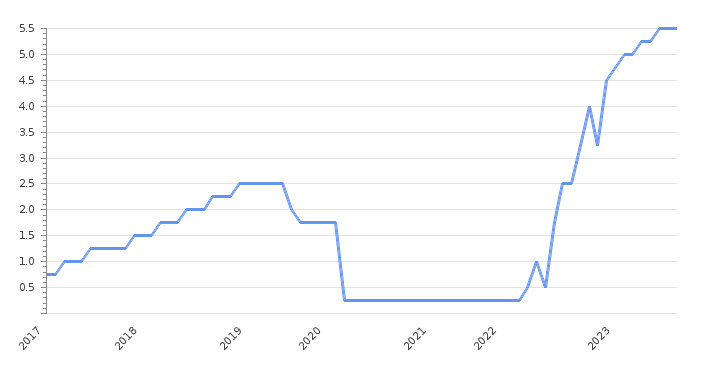

When will the Fed cut rates?

The main question is when the Fed will lower interest rates. This is of interest to analysts and financial market observers. According to analysis and forecasts, the likely month to start cutting rates is still September, as key elements of US inflation have started to show declines.

DNB Markets writes that they believed that current data would not change the likelihood of a rate cut in the autumn, provided inflation data remained moderate and labor market conditions continued to improve. Their forecasts indicate that the market expects the first rate cut in September.

According to inflation data released on Wednesday, overnight index swaps, which reflect traders' expectations of future interest rates, show that the market now fully appreciates the likelihood of a rate cut in September.

Two weeks ago, the first cut was not expected until December.

In 2024, expectations for a Fed rate cut have fallen significantly due to higher inflation in the first quarter of the year. Signals have emerged that some elements of the inflation basket will resist a change.

This boosted US bond yields and the US dollar in currency markets. Such a situation could happen again.

Until core inflation (excluding housing costs) and housing costs decline, the overall inflation rate will not be able to hold steady at the Fed's 2.0% target.

Housing costs, which account for about 40% of the overall consumer price index, have risen as a result of steady increases in home prices and rents in recent years.

However, PNC Bank says the April 2024 consumer price report may bring some relief to Fed policymakers, as the most stable housing and core services segments of the CPI showed the first signs of softening in a long time.

The core CPI declined to 0.2% month-over-month, and house price growth was just +0.2% month-over-month, the lowest since January 2021 (+0.6%).

PNC's forecast of two 25-basis-point rate cuts this year, in September and December, now seems more reasonable than earlier in 2024.

Other analysts are expressing a similar view. Berenberg believes the current inflation data makes it slightly more likely that the Fed will start cutting rates sooner.

"We continue to expect one 25-bp rate cut in December and three further such moves next year to bring the Fed funds target rate to 4.25–4.50%," Berenberg wrote.

Economists at Wells Fargo and Pantheon Macroeconomics also share this view. It takes some favorable inflation indicators for the Fed to feel confident about a rate cut. The first rate cut is possible at the FOMC meeting in September.

Pantheon Macroeconomics argues that the case for expecting a further slowdown in core inflation remains strong. Supply chains have stabilized, wage growth is slowing, and corporate margins remain strong, pointing to the outlook for the future.

Economists also note the lack of threat from global food and energy prices, as well as subdued rent growth and lower car prices. This indicates a slowdown in auto insurance inflation.

Thus, the stage is set for a further slowdown in the core CPI this summer, allowing the Fed to begin easing in September.

With the market consensus increasingly leaning toward a September rate cut, all eyes will be on upcoming macroeconomic data that could confirm these expectations.