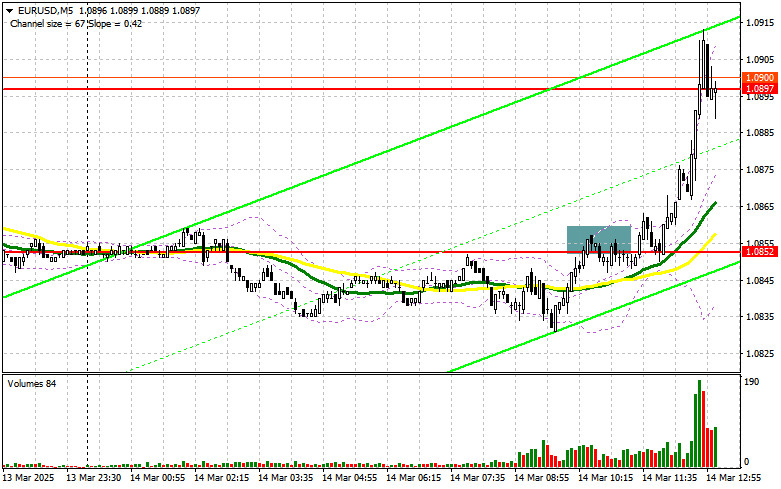

In my morning forecast, I focused on the 1.0852 level and planned to base my trading decisions on it. Let's examine the 5-minute chart to see what happened. A rise followed by a false breakout at 1.0852 provided an excellent short entry point, but the pair failed to experience a significant decline. The technical outlook has been revised for the second half of the day.

To Open Long Positions on EUR/USD:

Inflation data from Germany and France came in exactly as expected, leading to a modest strengthening of the euro in the first half of the day. During the U.S. session, a strong return in demand for the U.S. dollar is unlikely, so it is preferable to trade in favor of EUR/USD's upward movement.

The University of Michigan Consumer Sentiment Index and inflation expectations may trigger volatility but are unlikely to change the market trend. The main task for bulls in the second half of the day will be to defend the new support at 1.0886. A false breakout at this level will be an opportunity to buy EUR/USD, anticipating a further bullish move toward 1.0945, the upper boundary of the sideways channel.

A break and retest of this range from above will confirm a strong buy entry, with an upward target of 1.0997. The ultimate target will be the 1.1047 high, where I plan to take profits.

If EUR/USD declines and fails to attract buyers around 1.0886, the pair will remain within the channel, possibly leading to a minor correction. In this case, sellers may push the pair toward 1.0827. I will only consider buying after a false breakout at this level. If the pair drops further, I will open long positions on a rebound from 1.0770, targeting a 30-35 point intraday upward correction.

To Open Short Positions on EUR/USD:

Sellers remain inactive, making it unlikely that they will re-enter the market at the end of the week. For this reason, it is best not to rush into short positions and instead wait for a higher entry point. A false breakout around 1.0945 will provide a good opportunity to sell, targeting a correction toward support at 1.0886, just below the moving averages, which currently favor bulls.

A break and consolidation below this range would serve as another sell signal, pushing EUR/USD toward 1.0827. The final target for short positions will be 1.0770, where I will take profits.

If EUR/USD rises in the second half of the day and bears fail to act at 1.0945—which I doubt—buyers could trigger another major rally. In this case, I will postpone short positions until a test of the next resistance at 1.0997, where I will sell only after an unsuccessful breakout attempt. If there is no downward reaction, I will consider short positions on a rebound from 1.1047, aiming for a 30-35 point downward correction.

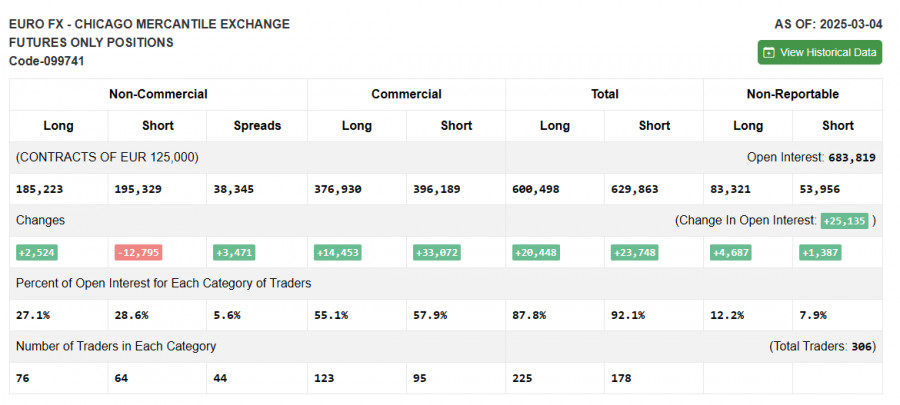

Commitments of Traders (COT) Report:

The COT report for March 4 showed an increase in long positions and a sharp reduction in short positions. More traders are willing to buy the euro, which has led to a significant strengthening of EUR/USD.

Germany's new fiscal stimulus measures have further boosted demand for the euro, and the ECB's cautious stance on future rate cuts has also supported EUR/USD, as reflected in the report. The previous slight advantage of euro sellers is no longer as influential, but caution is still needed when buying at current highs.

The COT report showed that long non-commercial positions increased by 2,524 to 185,223, while short non-commercial positions decreased by 12,795 to 195,329. As a result, the gap between long and short positions widened by 3,471.

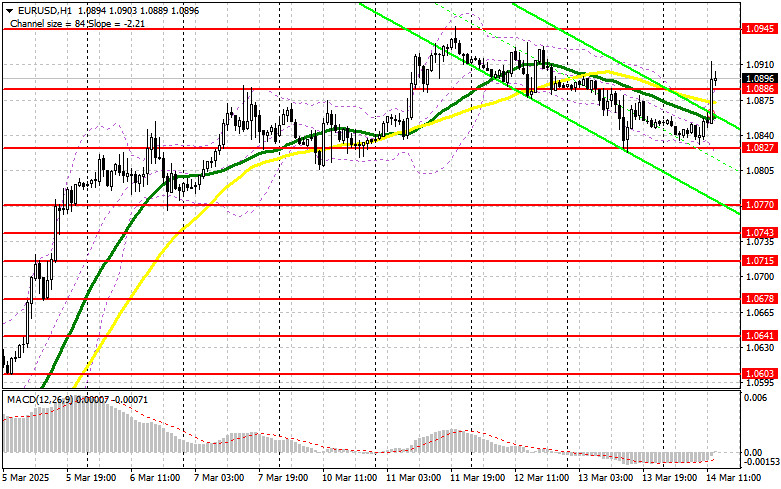

Indicator Signals:

Moving Averages:

Trading is occurring near the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The periods and prices of moving averages analyzed by the author are based on the H1 chart and differ from the standard daily moving averages on the D1 chart.

Bollinger Bands:

If EUR/USD declines, the lower boundary of the indicator around 1.0827 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing out volatility and noise.

- 50-period MA (yellow on the chart)

- 30-period MA (green on the chart)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period

- Slow EMA – 26-period

- SMA – 9-period

- Bollinger Bands: 20-period

- Non-commercial traders: Speculators, including individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total long open positions held by non-commercial traders.

- Short non-commercial positions: The total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions among non-commercial traders.