The EUR/USD currency pair experienced a relatively calm trading session throughout Wednesday; however, there is uncertainty regarding when the next collapse of the dollar might occur. Over the past week and a half, one thing has become clear: any new announcement of tariffs against any country in the world causes the dollar to plummet rapidly. There seems to be a sense of poetic justice in this. The market, much like the rest of the world, is clearly demonstrating to Trump how it feels about his political style.

It's not just the declining dollar; under Trump's administration, the U.S. stock market has been slipping, the cryptocurrency market is in decline, and American products, notably Tesla cars, are facing worldwide boycotts. It's important to mention that Tesla belongs to Trump's close ally, Elon Musk. Therefore, its stock is falling not only due to anti-American sentiment but also as a direct result of a rejection of Trump's policies, which Musk vocally supports.

Thus far, after two months of Trump's presidency, it is challenging to identify any positive developments. To clarify, we are not political analysts or strategists, nor are we fortune tellers. We do not possess insight into Trump's long-term goals. Perhaps in two years, it will become apparent that he has been making the right decisions and that the U.S. economy will flourish even more than before. However, at this moment, things appear absurd—not just to us, but to the entire world.

Just this Tuesday, Trump announced additional tariffs on Canada as part of his "tariffs for everyone" campaign. This decision, however, was not entirely without justification. The U.S. president was notably displeased that the province of Ontario raised electricity prices for the U.S. by 25%. In Trump's view, this was completely unjustified, prompting him to impose a further 25% tariff on Canadian steel and aluminum imports, bringing the total tariffs to 50%. He also declared a state of emergency in the region that relies on Canadian electricity. Furthermore, Trump warned of impending tariffs on Canadian automobiles, which he claimed would "destroy Canada's auto industry," as well as on Canadian lumber. The president believes that America is subsidizing Canada to the tune of $200 billion per year, and he insists that this situation cannot persist. According to Trump, the only way to prevent conflicts and disagreements is for Canada to simply become the 51st state of the United States.

As they say, the show goes on. The dollar continues to decline, and the market is largely ignoring macroeconomic and fundamental factors, which have become entirely uninteresting. Technical factors are also being overlooked. The U.S. currency keeps dropping almost daily, and when it isn't declining, the market remains stagnant, awaiting more news from Donald Trump. This is how 2025 has begun.

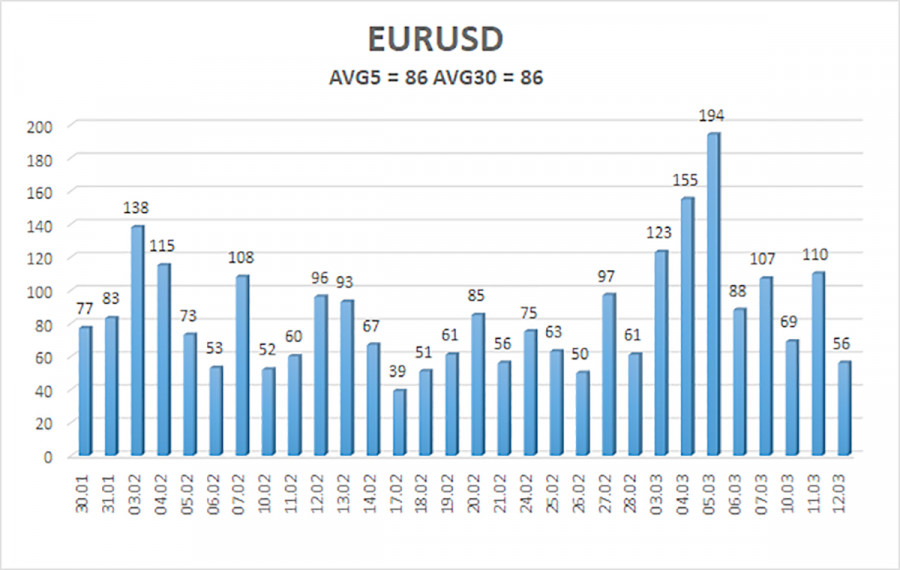

The average volatility of the EUR/USD currency pair over the last five trading days, as of March 13, is 86 pips and is considered "moderate." We expect the pair to move between the levels of 1.0823 and 1.0995 on Thursday. The long-term regression channel has turned upward, but the global downtrend remains intact, as seen on higher time frames. The CCI indicator dipped into oversold territory again, signaling another wave of upward correction, which now barely looks like a correction at all...

Nearest Support Levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest Resistance Levels:

R1 – 1.0986

Trading Recommendations:

The EUR/USD pair has exited the sideways channel and continues its rapid ascent. For months, we have been stating that we expect only a decline in the euro in the medium term, and that outlook has not changed. The dollar still has no fundamental reason for a sustained medium-term decline—except for Donald Trump. Short positions remain far more attractive, with targets at 1.0315 and 1.0254, though at this point, it is challenging to predict when this relentless growth will end. If you trade based purely on technical analysis, long positions can be considered as long as the price remains above the moving average, with targets at 1.0986 and 1.0995.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.