Analysis of Trades and Trading Advice for the British Pound

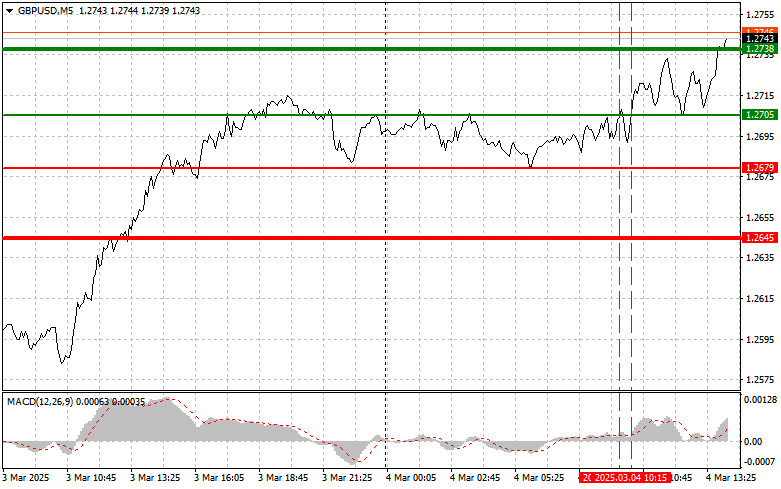

The test of the 1.2705 price level coincided with the moment when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound. A second test of 1.2705 shortly afterward, with the MACD in the overbought area, triggered Scenario #2 for selling, but the pair failed to decline, leading to a stop-out on the position.

With no significant macroeconomic data from the UK, the pound continued to rise, benefiting from strong demand in a developing uptrend, as well as from recent signals suggesting a potential slowdown in the Bank of England's rate-cut cycle. External factors also played a role. The weakening U.S. dollar, driven by uncertainty surrounding the Federal Reserve's monetary policy and Trump's aggressive trade policies, also supported the pound. However, despite the optimistic market sentiment, traders should remain cautious about buying an overbought pound, as global risks remain high, and a U.S.-UK trade war seems inevitable.

The positive trend may persist in the second half of the day, as even strong data on the U.S. RCM/TIPP Economic Optimism Index is unlikely to significantly damage the pound's upward momentum. Fundamental factors continue to support the British currency, while the U.S. dollar remains under pressure due to uncertainty over the Fed's future monetary policy. The upcoming speech by FOMC member John Williams could serve as a catalyst for further pound strengthening, so investors will be closely monitoring his rhetoric.

Williams is expected to adopt a dovish stance, emphasizing the need for interest rate cuts to support economic growth. Such remarks could increase pressure on the dollar, as lower rates make the U.S. currency less attractive to investors.

Regarding intraday strategy, I will primarily focus on implementing Scenario #1 and Scenario #2.

Buy Signal

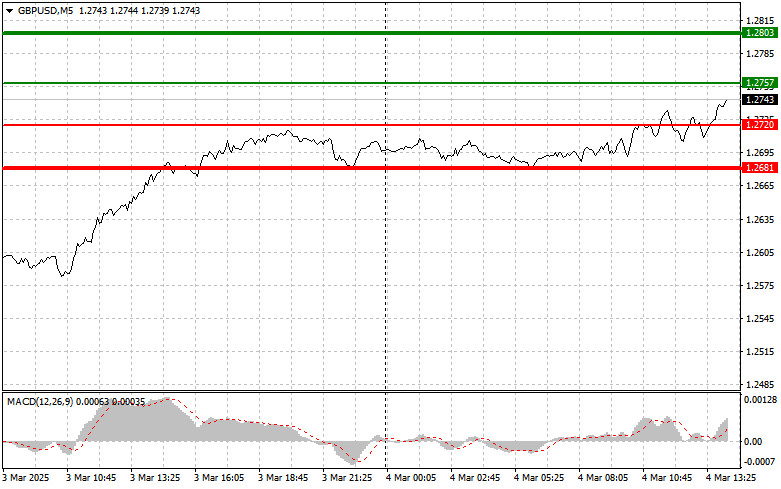

Scenario #1: Buying the pound today is possible if the price reaches 1.2757 (green line on the chart), with a target of 1.2803. At 1.2803, I plan to exit the trade and open short positions in the opposite direction, aiming for a 30-35 point correction from the entry point. Pound growth today can only be expected if U.S. data turns out weak. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I will also consider buying the pound today if the price undergoes two consecutive tests of 1.2720, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a bullish reversal. Growth can be expected toward the 1.2757 and 1.2803 levels.

Sell Signal

Scenario #1: Selling the pound today is planned after the price drops below 1.2720 (red line on the chart), leading to a quick decline. The key target for sellers will be 1.2681, where I will exit the trade and buy immediately in the opposite direction, aiming for a 20-25 point correction. Bearish pressure will likely emerge if U.S. data is strong. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I will also consider selling the pound today if the price undergoes two consecutive tests of 1.2757, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a bearish reversal. A decline toward the 1.2720 and 1.2681 levels can be expected.

Chart Breakdown

- The thin green line represents the entry price for buying the trading instrument.

- The thick green line represents the estimated take profit level or a level where traders can manually lock in profits, as further upside beyond this level is unlikely.

- The thin red line represents the entry price for selling the trading instrument.

- The thick red line represents the estimated take profit level or a level where traders can manually lock in profits, as further downside beyond this level is unlikely.

- MACD Indicator: When entering the market, it is essential to consider overbought and oversold zones.

Important Notes

Beginner Forex traders must exercise extreme caution when entering the market. It is best to stay out of trading before major fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss protection, traders can quickly lose their entire deposit, especially if they are trading large positions without proper risk management.

A clear trading plan is essential for success—similar to the one outlined above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.