The EUR/USD currency pair continued to decline on Wednesday, marking its third consecutive day of downward movement. However, market volatility remained extremely low, indicating that traders are in a waiting mode, anticipating a significant event. On Monday, we noted that there would be very few important occurrences this week. We noted that the euro's growth last week seemed largely illogical. However, how else can the euro make at least a slight correction on the daily timeframe, if not through this illogical rise?

The euro finds itself in an unusual situation, where nearly all factors are working against it. Throughout last year, we argued that the market had already priced in the entire cycle of the Federal Reserve's monetary easing in advance, suggesting that the euro would continue to decline. We even pinpointed a date for when this decline would begin—September 18, the day of the Fed meeting where the first rate cut was anticipated. Since then, the euro has been falling with minimal significant corrections. The movements observed over the past month can hardly be classified as a rally; instead, they appear more like a flat trend on the daily TF.

At the start of 2024, it also became clear that the Fed was not only resisting market expectations of rate cuts, but it might not cut rates at all. Is this unbelievable? It is a very realistic scenario over the next one to two years. Let's break it down:

The market expected 6-7 rate cuts in 2024 but never materialized. The market anticipated four rate cuts in 2025, but the Fed clarified that the maximum is likely only two. And with Donald Trump back as president, many analysts are now concerned about a potential inflation surge, driven by his intention to start a global trade war. So far, Trump hasn't fully engaged in trade conflicts (except with China), yet U.S. inflation has already climbed to 3%. What will happen if he expands trade disputes to Canada or the EU?

If the Fed was already hesitant to ease monetary policy when inflation was at 2.5%, what stance should it take now? We believe that no interest rate cuts will occur anytime soon, and this scenario remains highly unlikely even throughout 2025. It is also important to note that the Fed is in no rush— the U.S. economy is growing at a solid pace, unemployment is low, and the labor market remains stable. The European Central Bank and the Bank of England should be more concerned about stagnation, not the Fed. Therefore, if the Fed decides not to implement any rate cuts, there is nothing alarming about this decision. In the meantime, the U.S. dollar has a strong fundamental basis to appreciate throughout most of 2025. Additionally, the EUR/USD pair is currently experiencing two bearish trends: a 4-month downtrend and a 16-year downtrend.

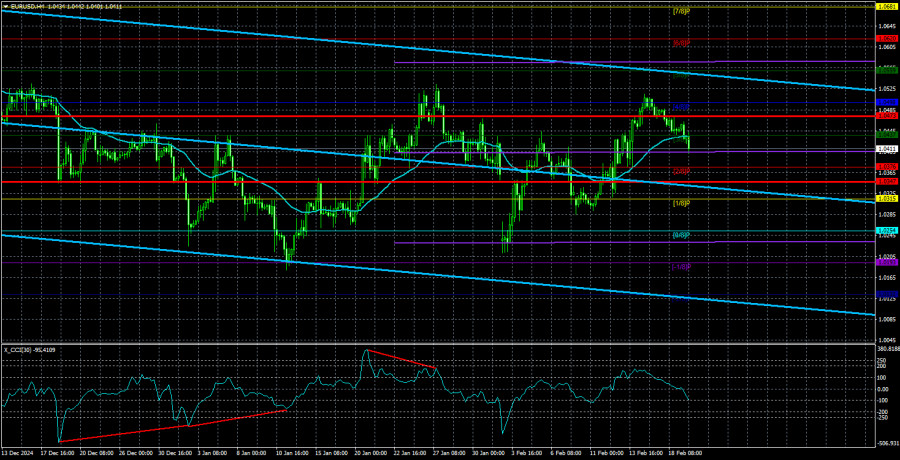

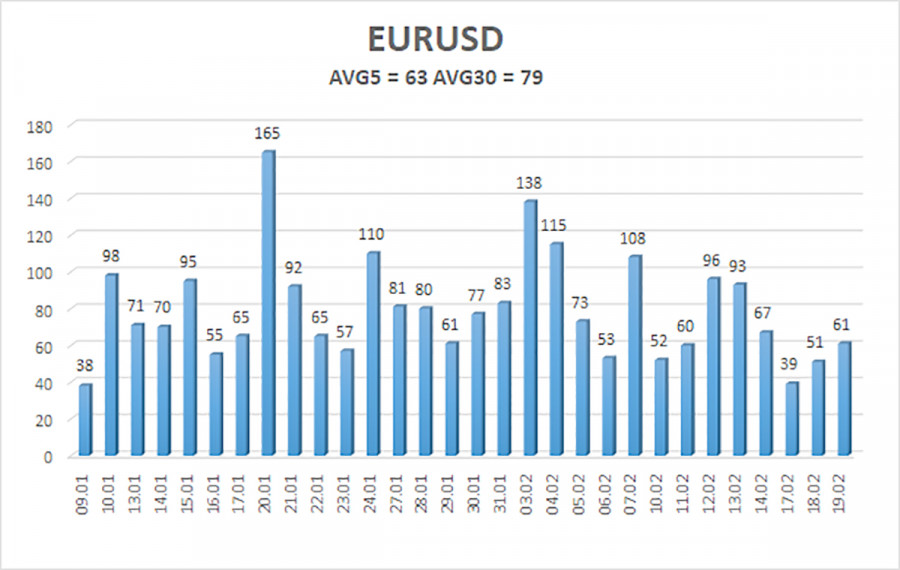

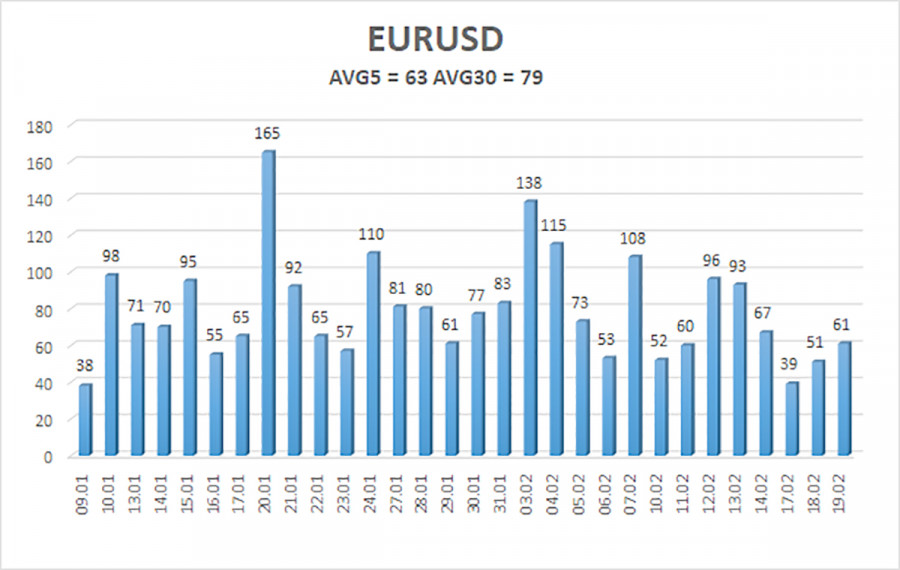

The average volatility of EUR/USD over the past five trading days as of February 20 stands at 63 pips, which is considered "average." We expect the pair to trade between 1.0347 and 1.0473 on Thursday. The long-term regression channel remains downward, signaling that the global bearish trend is intact. The CCI indicator entered the oversold zone, which triggered a minor upward retracement.

Nearest Support Levels:

S1 – 1.0376

S2 – 1.0315

S3 – 1.0254

Nearest Resistance Levels:

R1 – 1.0437

R2 – 1.0498

R3 – 1.0559

Trading Recommendations:

The EUR/USD pair remains in a corrective upward movement. Over the past few months, we have consistently stated that the medium-term outlook for the euro remains bearish, and nothing has changed. The dollar still has no reason to decline in the medium term, except for purely technical corrections.

Short positions remain more attractive, with initial targets at 1.0376 and 1.0347, as long as the price remains below the moving average. However, technical corrections could continue for some time. For traders using pure technical analysis, long positions can be considered if the price moves above the moving average, with targets at 1.0473 and 1.0498. However, any euro rally should still be viewed as a correction on the daily TF.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.